It takes a few minutes, but the best way to get discount auto insurance rates in Lexington is to regularly compare price quotes from different companies in Kentucky. Prices can be compared by following these steps.

It takes a few minutes, but the best way to get discount auto insurance rates in Lexington is to regularly compare price quotes from different companies in Kentucky. Prices can be compared by following these steps.

First, learn about car insurance and the modifications you can make to drop your rates. Many factors that result in higher rates like traffic tickets, fender benders, and a not-so-good credit rating can be controlled by being financially responsible and driving safely. Later in this article we will cover more information to prevent rate hikes and find additional discounts.

Second, request rate estimates from direct, independent, and exclusive agents. Exclusive agents and direct companies can give quotes from a single company like GEICO or Allstate, while independent agencies can quote rates from many different companies.

Third, compare the new rate quotes to your current policy premium to see if a cheaper price is available in Lexington. If you find a better price and switch companies, make sure there is no coverage gap between policies.

Fourth, provide proper notification to your current company to cancel your current coverage and submit a signed application and payment to your new company or agent. Once received, store the certificate verifying proof of insurance along with the vehicle’s registration papers.

One key aspect of rate comparisons is to try to compare identical limits and deductibles on every price quote and and to get price quotes from as many different insurance providers as possible. This guarantees a fair price comparison and plenty of rates choose from.

Inconceivable but true, the vast majority of consumers kept their coverage with the same car insurance company for at least four years, and nearly the majority have never compared quotes from other companies. The average driver in the United States could save as much as $859 each year just by shopping around, but they assume it’s a waste of time to save money by comparing rate quotes.

Auto insurance providers offering competitive rate quotes in Kentucky

The companies in the list below offer price quotes in Kentucky. To locate cheap car insurance in Lexington, we suggest you compare several of them to get a more complete price comparison.

Car insurance rates and discounts

Auto insurance companies do not advertise every discount in an easy-to-find place, so the below list has a few of the more well known as well as the least known discounts that may be available. If you aren’t receiving every discount available, you could be paying more than you need to.

- Payment Method – If you can afford to pay the entire bill instead of monthly or quarterly installments you can actually save on your bill.

- Clubs and Organizations – Being in qualifying clubs or civic groups is a simple method to lower premiums on your next car insurance statement.

- Air Bag Discount – Factory air bags can get savings of 25 to 30%.

- Discounts for Responsible Drivers – Drivers without accidents can save up to 40% or more on their Lexington car insurance quote compared to accident prone drivers.

- Anti-lock Brake Discount – Cars, trucks, and SUVs with anti-lock braking systems can stop better under adverse conditions and the ABS can save up to 10%.

- Distant College Student Discount – Children who are enrolled in a college that is more than 100 miles from Lexington without a vehicle on campus can be insured at a reduced rate.

- Seat Belts Save – Drivers who always wear seat belts and also require passengers to buckle up before driving can save up to 10 percent (depending on the company) off the medical payments premium.

- Data Collection Discounts – Insureds who allow driving data submission to scrutinize driving habits by using a telematic data system such as Progressive’s Snapshot could see a rate decrease as long as the data is positive.

- First Accident Forgiveness – Not really a discount, but companies like GEICO, Allstate and Liberty Mutual permit an accident before your rates go up if you are claim-free for a set time period.

- Discount for Good Grades – Being a good student can earn a discount of 20% or more. Many companies even apply the discount to college students until age 25.

Don’t be shocked that some credits don’t apply to the whole policy. Most only cut individual premiums such as physical damage coverage or medical payments. Even though it appears you would end up receiving a 100% discount, companies wouldn’t make money that way. But all discounts should help reduce your overall premium however.

A few popular companies and a selection of discounts are detailed below.

- Esurance policyholders can earn discounts including Pac-12 alumni, multi-policy, good driver, good student, homeowner, renters, and online quote.

- The Hartford discounts include vehicle fuel type, defensive driver, driver training, air bag, bundle, and good student.

- AAA may include discounts for multi-policy, anti-theft, good student, education and occupation, and good driver.

- GEICO has discounts for good student, membership and employees, five-year accident-free, multi-vehicle, air bags, defensive driver, and military active duty.

- State Farm has savings for accident-free, passive restraint, student away at school, anti-theft, and multiple autos.

Before purchasing a policy, check with each company which discounts can lower your rates. Some of the discounts discussed earlier may not apply to policyholders in your area. If you would like to see a list of insurance companies that have a full spectrum of discounts in Kentucky, follow this link.

Get rate quotes but still have a local neighborhood Lexington car insurance agent

Certain consumers would rather talk to an insurance agent. The biggest benefit of getting free rate quotes online is the fact that you can find the best rates but still work with a licensed agent.

To find an agent, once you fill out this quick form, the quote information is emailed to companies in Lexington that give free quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to leave your computer because prices are sent to the email address you provide. You can get cheaper auto insurance rates without requiring a lot of work. If you want to compare prices from one company in particular, you would need to navigate to their website and fill out the quote form the provide.

To find an agent, once you fill out this quick form, the quote information is emailed to companies in Lexington that give free quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to leave your computer because prices are sent to the email address you provide. You can get cheaper auto insurance rates without requiring a lot of work. If you want to compare prices from one company in particular, you would need to navigate to their website and fill out the quote form the provide.

Selecting an insurer should include more criteria than just the bottom line cost. Any agent in Lexington should have no problem answering these questions:

- Can they provide you with a list of referrals?

- Will a damage claim use OEM or aftermarket replacement parts?

- Do they get paid more for recommending certain coverages?

- Does the quote include credit and driving reports?

- Is the agency involved in supporting local community causes?

When researching a reputable insurance agent or broker, it helps to know the two types of agencies and how they can service your needs differently. Insurance agencies in Lexington can be classified as either independent agents or exclusive agents.

Exclusive Agencies

These type of agents write business for a single company and examples are Allstate and State Farm. Exclusive agencies are unable to compare other company’s rates so they are skilled at selling on more than just price. Exclusive agencies are usually well trained on sales techniques and that can be a competitive advantage.

The following is a list of exclusive insurance agencies in Lexington willing to provide comparison quotes.

Wallace Barber – State Farm Insurance Agent

340 E New Cir Rd #120 – Lexington, KY 40505 – (859) 543-0300 – View Map

State Farm – Bob Pitman

851 Corporate Dr Ste 200 – Lexington, KY 40503 – (859) 223-1191 – View Map

Stewart Perry – State Farm Insurance Agent

2128 Nicholasville Rd – Lexington, KY 40503 – (859) 277-7195 – View Map

Independent Auto Insurance Agencies

Independent agencies are not restricted to one company so they can quote policies amongst many companies and find the cheapest rate. If you are not satisfied with one company, they simply move the coverage in-house and you can keep the same agent. When comparing auto insurance prices, you need to get insurance quotes from several independent insurance agents to maximize your price options.

Below is a list of independent agencies in Lexington willing to provide price quote information.

Neely Taylor-Wade Insurance

133 Walton Ave – Lexington, KY 40508 – (859) 233-7855 – View Map

Reynolds Insurance Agency Inc

1500 Leestown Rd #160 – Lexington, KY 40511 – (859) 412-4636 – View Map

Nationwide Insurance: Turner Ins Group LLC

3320 Clays Mill Rd #211 – Lexington, KY 40503 – (859) 219-0972 – View Map

Once you have acceptable answers to your questions as well as a price you’re happy with, you may have just found an insurance agency that can properly service your auto insurance policy.

You may need specialized car insurance coverage

Always keep in mind that when comparing a policy, there is no perfect coverage plan. Coverage needs to be tailored to your specific needs so this has to be addressed.

Here are some questions about coverages that might point out whether or not you would benefit from professional advice.

- What is an adequate liability insurance limit?

- What vehicles should carry emergency assistance coverage?

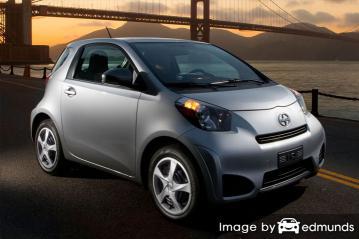

- Does my Scion iQ qualify for pleasure use?

- How high should deductibles be on a Scion iQ?

- How high should my medical payments coverage be?

- Does my car insurance cover rental cars?

- Is my Scion iQ covered for smoke damage?

- Does my policy pay for OEM or aftermarket parts?

If you can’t answer these questions but a few of them apply, then you may want to think about talking to an insurance agent. To find an agent in your area, simply complete this short form or go to this page to view a list of companies.

What car insurance coverages do you need?

Understanding the coverages of your policy can help you determine the best coverages at the best deductibles and correct limits. Policy terminology can be difficult to understand and reading a policy is terribly boring. Shown next are typical coverages found on the average car insurance policy.

Liability car insurance

This can cover injuries or damage you cause to people or other property. It protects YOU from claims by other people. Liability doesn’t cover damage to your own property or vehicle.

It consists of three limits, per person bodily injury, per accident bodily injury, and a property damage limit. As an example, you may have values of 25/50/10 that translate to $25,000 in coverage for each person’s injuries, $50,000 for the entire accident, and a total limit of $10,000 for damage to vehicles and property.

Liability can pay for claims such as repair costs for stationary objects, emergency aid, medical services, funeral expenses and legal defense fees. The amount of liability coverage you purchase is a decision to put some thought into, but it’s cheap coverage so purchase as much as you can afford. Kentucky state law requires minimum liability limits of 25/50/10 but it’s recommended drivers buy better liability coverage.

The illustration below shows why buying minimum limits may not provide adequate coverage.

Protection from uninsured/underinsured drivers

This provides protection when other motorists are uninsured or don’t have enough coverage. Covered losses include hospital bills for your injuries and damage to your Scion iQ.

Due to the fact that many Kentucky drivers carry very low liability coverage limits (which is 25/50/10), their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages should not be overlooked.

Collision coverage

Collision coverage will pay to fix damage to your iQ resulting from colliding with a stationary object or other vehicle. A deductible applies then the remaining damage will be paid by your insurance company.

Collision insurance covers claims like rolling your car, hitting a parking meter, damaging your car on a curb, scraping a guard rail and backing into a parked car. Collision is rather expensive coverage, so consider dropping it from lower value vehicles. Another option is to bump up the deductible on your iQ to save money on collision insurance.

Medical expense insurance

Medical payments and Personal Injury Protection insurance kick in for immediate expenses such as hospital visits, rehabilitation expenses, doctor visits and funeral costs. They are often used to cover expenses not covered by your health insurance program or if you do not have health coverage. Medical payments and PIP cover both the driver and occupants and will also cover if you are hit as a while walking down the street. Personal injury protection coverage is not universally available and may carry a deductible

Comprehensive (Other than Collision)

Comprehensive insurance pays to fix your vehicle from damage OTHER than collision with another vehicle or object. A deductible will apply and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive insurance covers things like a tree branch falling on your vehicle, hitting a bird and falling objects. The maximum payout your car insurance company will pay is the market value of your vehicle, so if the vehicle is not worth much consider removing comprehensive coverage.

Quote more and you will save more

When getting Lexington car insurance quotes online, it’s a bad idea to reduce coverage to reduce premium. In too many instances, an insured cut uninsured motorist or liability limits only to regret that they should have had better coverage. The proper strategy is to purchase a proper amount of coverage for the lowest cost, but do not skimp to save money.

We just covered many tips how you can get a better price on Scion iQ insurance in Lexington. The most important thing to understand is the more rate comparisons you have, the higher the chance of saving money. Drivers may even discover the lowest premium rates come from the least-expected company. Regional companies may only write in your state and offer lower prices than the large multi-state companies such as State Farm or Progressive.

More detailed auto insurance information can be found at these sites:

- Distracted Driving Extends Beyond Texting (State Farm)

- Who Has Cheap Auto Insurance Rates for a Toyota Highlander in Lexington? (FAQ)

- Who Has the Cheapest Lexington Car Insurance Rates for Drivers Over Age 50? (FAQ)

- Credit Impacts Car Insurance Rates (State Farm)

- What are my Rights when Filing a Claim? (Insurance Information Institute)